Subscribe to join thousands of other ecommerce experts

Avinash Kaushik, Head of Strategic Analytics at Google, once wrote in his personal blog: “What is ROAS? Return on Ad Spend. It is a navel-gazing advertising-centric metric. It is not a business metric.”

The article was titled Die, ROAS, Die.

Strangely enough, if you search “what is ROAS” on Google, Avinash’s answer is not the featured snippet 😉

ROAS is a seemingly mundane marketing metric, calculated as the ratio of revenue to advertising costs. And yet it is so much more than that: ROAS is perhaps the single most widely-used (and abused) KPI in the performance marketing industry – plus it is the cornerstone of Google’s Target ROAS bidding technology and a key way that Google demonstrates value to its advertisers.

So what can make a 14-year veteran of Google lift his pen and (even if tongue-in-cheek) write, “I profoundly dislike ROAS, and if you like ROAS, chances are that I like you less”?

ROAS is a fascinating but flawed metric that misleads many advertisers to confuse efficiency with effectiveness. This article examines the good and the bad when it comes to ROAS and revenue optimization, and your likelihood of net positive financial outcomes. In the interest of being solution-oriented, I will also quickly review ROAS alternatives to revenue-based ROAS measurement and propose why adopting such alternatives is likely to help you outpace the market. This article will primarily use Google Shopping as an example, but the principles apply to other ecommerce marketing channels as well.

Let’s discuss:

- ROAS: what is it and why is it so popular?

- The danger in using ROAS

- ROAS alternatives: how to outcompete by ditching this metric

Table of Contents

What is ROAS, why is it so popular, what about ACoS?

Return on Advertising Spend, or ROAS, is the ratio of marketing return to advertising cost. It is calculated as revenue / cost or, in Google Ads, as conversion value / cost. Wow, that is simple. +1 for ROAS.

This metric is so popular because, as long as conversion tracking is installed, it is easily and universally calculable for all campaign entities – from a campaign itself, to an ad group, product type, brand, item ID, keyword, search term, etc – or even across channels. Likewise, it is highly versatile in terms of time period, able to be reported and studied from hourly all the way up to yearly within Google Ads.

More to the point, ROAS measures efficiency, and this is a very attractive quality that elevates it from a mere metric to a much-obsessed-over KPI. Specifically, it measures range – answering the question: if I spend x, I will get y. The logic is quite similar to an auto’s miles-per-gallon. Conversely, Advertising Cost of Sale (ACoS, popular in the Amazon ad ecosystem) is an efficiency metric that solves for consumption.

Born from two trivially-reported numbers – revenue and cost – the value of ROAS is extrapolated from range efficiency to something that is a bit more elusive. It is frequently taken as a proxy for a deeper business objective: profit. More on that later.

In summary so far, the ability of ROAS to simply and comparably measure efficiency across nearly every campaign dimension or combination thereof at any time scale has made the metric/KPI extremely popular, and understandably so.

A short post-script: Google’s more open-ended calculation of ROAS as conversion value divided by cost is actually super cool, because conversion value can be any value that you can track or import, not just revenue. That’s powerful.

The danger in using ROAS

As an efficiency metric, there’s no doubt that ROAS is a useful KPI. What is problematic, however, is how frequently it is overextended to other applications. Moreover, I would challenge whether it is even fit for one of its most common uses: to assess campaign profitability. In order to unpack this, let’s take a look at two topics:

- KPI surrogation – an effect observed when focus on a proxy metric overtakes the underlying strategy

- The Law of the Instrument, aka Maslow’s Hammer – a cognitive bias resulting from over-reliance on a familiar tool, or when tool selection is limited

A proxy is an indirect measurement of a desired outcome, typically used when the desired outcome cannot be directly measured or observed. The proxy has value because of its correlation to the goal – and the higher the correlation, the higher the value or effectiveness of the proxy will be.

ROAS is commonly used as a proxy for campaign profitability, yet there are immediate red flags. First, is a proxy even necessary? It is possible to track profit instead of revenue, and although it’s more challenging than tracking revenue, this is a direction in which more businesses should travel. Second, how tight is that correlation between ROAS and profit?

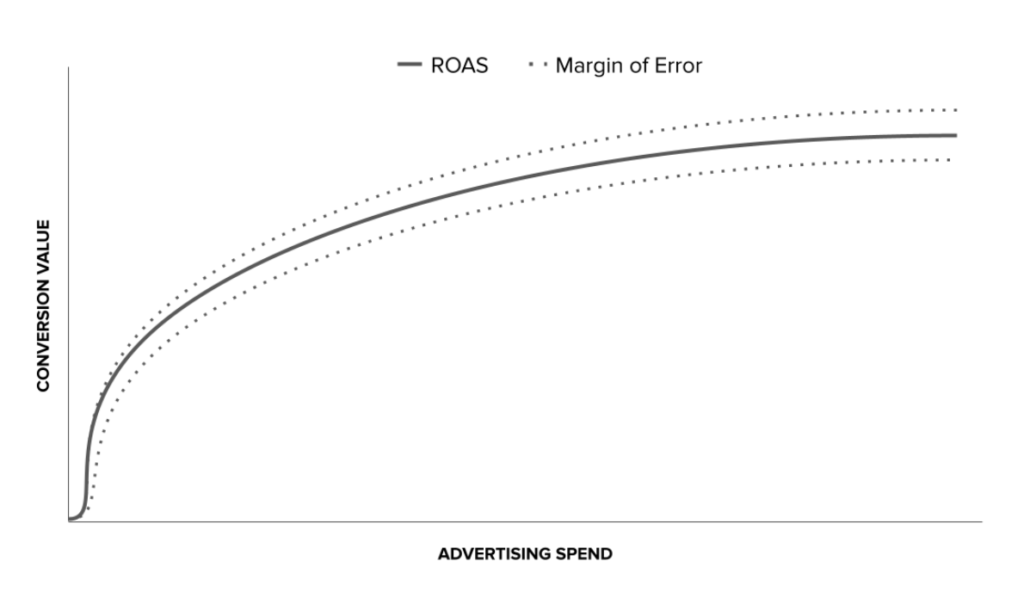

This is tricky, because if there were a very poor correlation, business outcomes would be disastrous and no one would use ROAS. Instead (dependent on the care and method with which ROAS targets are selected) there seems to be a pretty decent correlation between ROAS and profit. Why is that tricky? You might get lulled into complacency by a good ROAS, yet there is still a margin of error baked into every decision based on ROAS (fig. 1). This “looseness” can cut both ways with equal opportunity – disguising unprofitable sales as superficially profitable on the one hand, and leading to missed opportunities on the other.

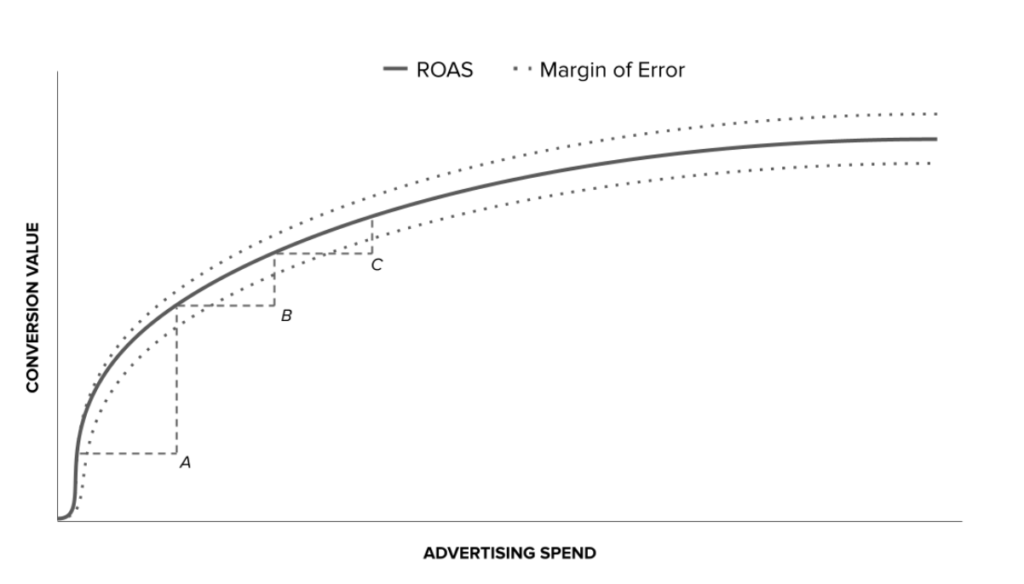

That might not be so tragic when you are first ramping up advertising spend and seeing a high level of incremental return. But the nature of these channels is such that every additional euro, pound, or dollar spent will tend to be less productive than the last. This is called a response curve. Assuming the margin of error between ROAS and profit remains relatively constant as you travel along that curve, then the mismatch becomes more troublesome as your spend increases (fig. 2). You have less room for error. It’s not likely to tank your business outright, but it can be a bit like a war of attrition: death by a thousand cuts – or clicks.

“The Surrogation Snare”

So, what about KPI surrogation? KPIs are selected because they help quantify a strategy, which might otherwise be abstract. And quantification is like catnip for us. Along the way, we often work with imperfect metrics, and that’s ok. What’s not ok is when we mentally substitute the metric for the strategy. This is a psychological phenomenon called surrogation.

Every day, across almost every organization, strategy is being hijacked by numbers . . . It turns out that the tendency to mentally replace strategy with metrics—called surrogation—is quite pervasive. And it can destroy company value.

Harris & Tayler, Harvard Business Review

As digital marketing strategist Anders Hjorth writes, “a bid strategy is not a paid search strategy. Setting bids for paid search is simply optimization.” Think of it this way: if a ROAS target were a strategic goal, then you would not use that goal as a tool – you would instead use other tools to achieve that goal.

Does this sound familiar?

- Our costs are too high, let’s adjust ROAS

- Now our revenue is too low, let’s adjust ROAS

- Now our ROAS is off target, let’s… adjust ROAS?

This is a self-referential tangle, resulting from goal incoherence and overemphasizing the strategic importance of ROAS. Growing profit is likely the actual strategy in this example, measured by revenue growth at a certain ROAS threshold.

Unfortunately, revenue growth and ROAS optimization will tend to have, if not an inverse correlation, then at least an adversarial relationship. Paid search expert Kirk Williams has written about this in some detail. As illustrated in the response curve above, ROAS is a limiter on revenue growth. You can optimize that response curve (what I call “bending the spoon”), but you can never eliminate it.

ROAS: hardly a Swiss Army knife

Related to the effect of KPI surrogation, another bias is at work here: The Law of the Instrument, also known as Maslow’s Hammer. This bias occurs when a given tool is relied on too heavily, including in wrong applications.

I suppose it is tempting, if the only tool you have is a hammer, to treat everything as if it were a nail.

Abraham Maslow, The Psychology of Science

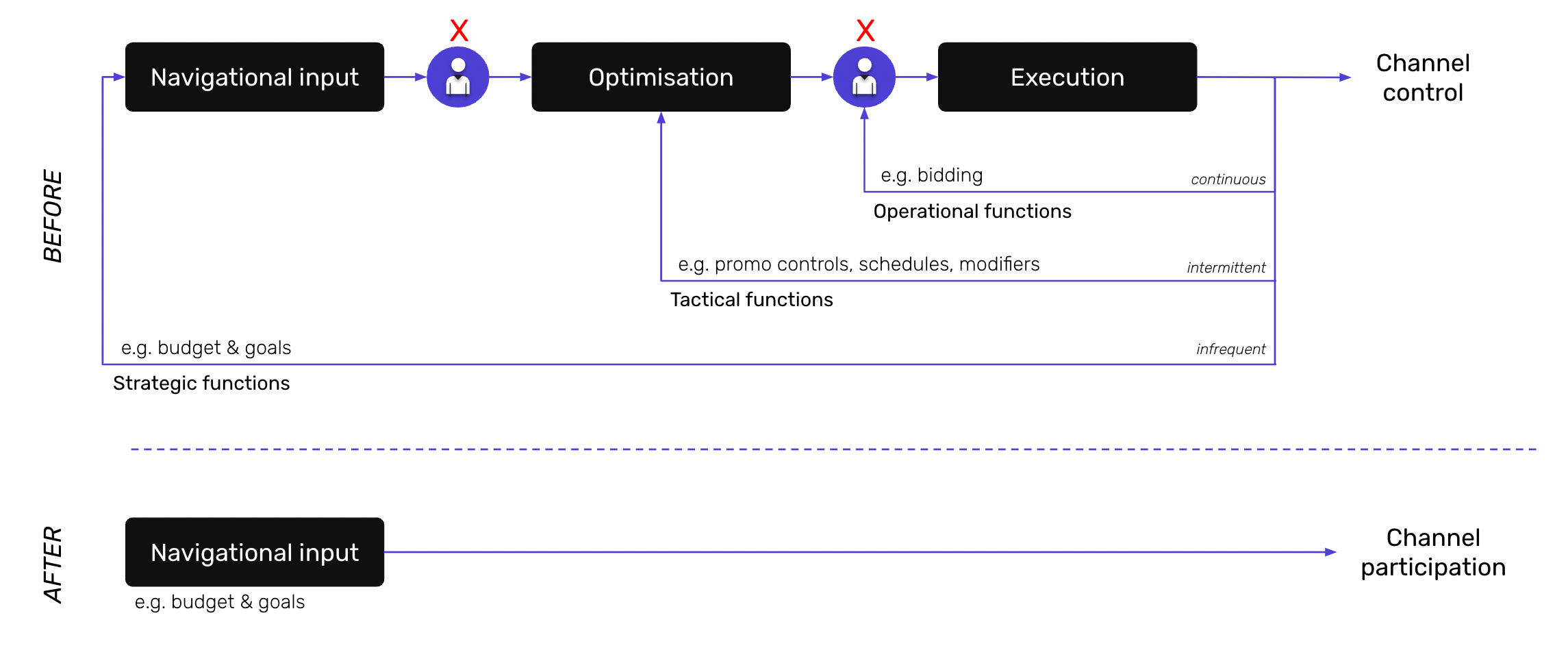

Besides being an overvalued proxy metric, ROAS becomes a tool for everything. This is partly induced by the Google advertising platform itself. ROAS is a prominent bidding criteria, and as Google reduces promotional controls via increasing levels of automation, there are less “knobs and dials” to turn – fewer tools and tactics available.

This is challenging because ROAS is a result of well-functioning campaigns, or conversely, a symptom of low-performance campaigns. In and of itself, ROAS offers low diagnostic value. Modifying ROAS targets can be a bit like regulating a fever with a pill – without understanding the root cause of the illness.

If you decompose the “return” part of ROAS, you’ll find that the key variables are conversion rate and average order value. These metrics are actually what need to be addressed to improve campaign performance – and in turn they point to topics like audience, pricing, user experience, and more.

It is a complex array of multivariate, indeterministic challenges – of which ROAS is a product rather than a cause. You need to drop Maslow’s Hammer and open the full toolbox, insofar as the platform allows you…

Which brings us to the next topic.

Navigating out-of-the-loop automation technology

Google’s advertising automation is often described as a black box, which is considered challenging by many marketers. Let’s quickly unpack that and how it relates to revenue and ROAS optimization, because – as with most challenges – there is an opportunity to be found. It is the opportunity around revenue and ROAS optimization.

If we borrow an automation framework from the world of self-driving cars, we’ll see that driving is the sum of monitoring and control activity at multiple levels ranging from navigation, to event detection & response, to physical actions.

In my view, this is a very suitable framework for describing how campaigns are controlled as well.

Automation seeks to overtake different control loops. Humans, in turn, can occupy three different states along along a spectrum of awareness and control.

- In the loop: Humans in direct control of the campaign and monitoring the situation

- On the loop: Humans not in direct control of the campaign but monitoring the situation

- Out of the loop (OOTL): Humans not in direct control of the campaign and not monitoring the situation

I’d argue that Google technology is getting pretty far along the spectrum toward OOTL. Not only are campaign actions being reduced, but also observability and reporting are threatened in some cases – to prevent users from being agitated into action.

As Google Ads becomes more fully automated, businesses with a high paid search traffic share face a two-fold challenge: how to guide the platform toward their objectives and how to differentiate from competitors deploying the same tech

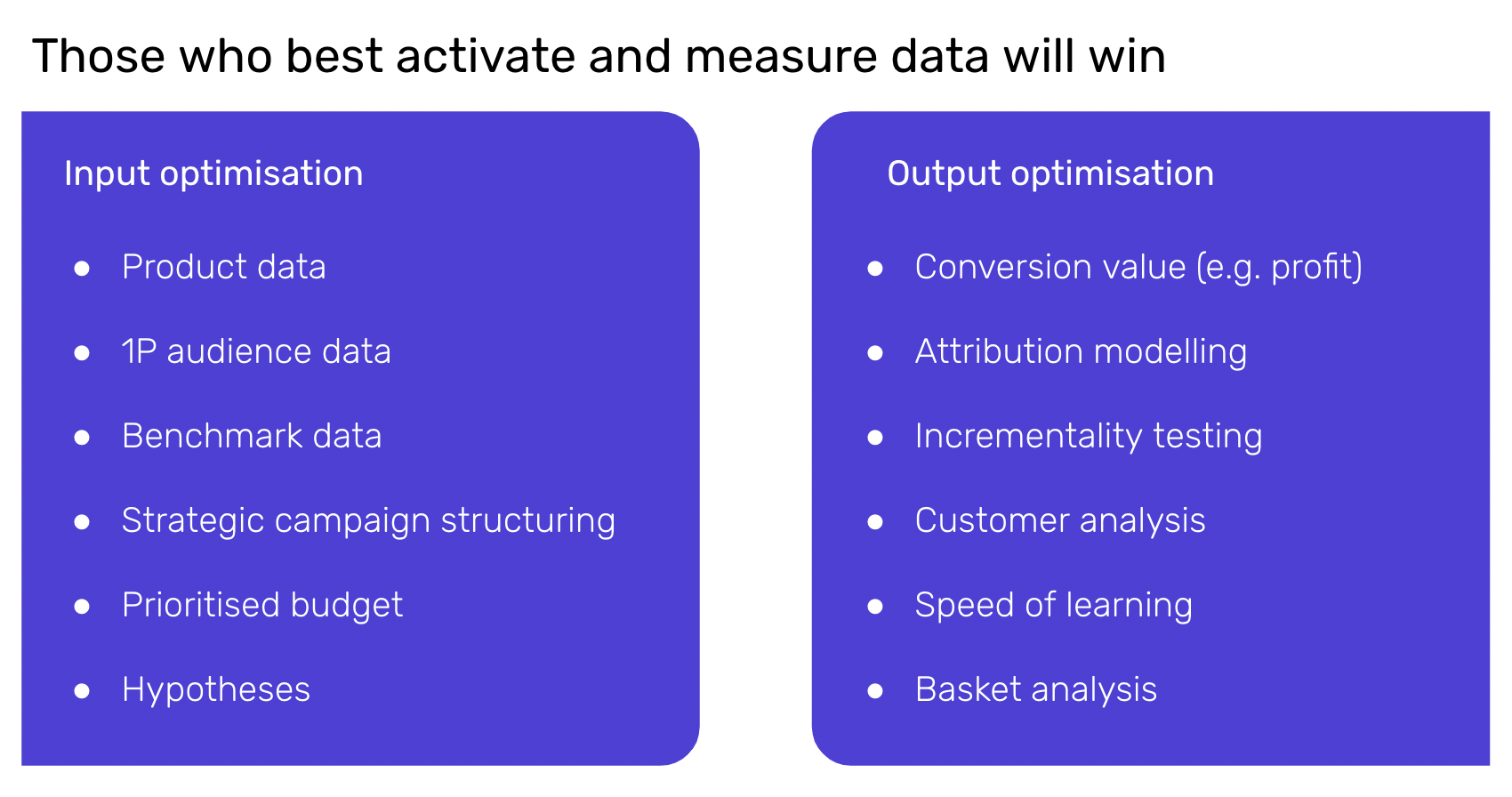

In an OOTL system where you have only input and output, it becomes very important to measure the right things, measure them better, and offer smart inputs. Posed with the question “What if Google Ads goes fully automated – how would you adapt?”, Kirk Williams answered:

“Automation revolves around inputs and outputs. This means our jobs should shift to focus on these so I would ask ‘how can I improve one or both of those’?”

I couldn’t agree more.

There are many areas to tackle here, but since we are discussing revenue and ROAS optimitation, let’s narrow that down for the moment. I would content that businesses that measure and optimize based on profit will outperform those who do not in the medium and long term. And profit is a layered onion: you can drill from gross margin to contribution margin to net margin. You can also aggregate it to model customer lifetime value.

ROAS alternatives (a concise overview)

To be clear, we have now reached a massive topic that could and should be its own article. In order to recap how we got here: ROAS is a great efficiency metric, but a poor substitute for profit. Mentally substituting ROAS for profitability can be harmful – perhaps not to your campaigns, but to your business; maybe not today, but tomorrow. We currently operate in a saturated, competitive marketing environment where the technology increasingly constrains our ability to tactically differentiate. Offering the system better inputs, and measuring the outputs of that system better, are therefore two crucial ways to achieve excellence in Shopping ads (or any channel!). They always have been, but now more than ever.

Let’s briefly run through some measurement options, based on the example of Google Shopping. If you would like to learn more about these topics, you might consider digging into content from SMX conferences such as this presentation from brilliant technical marketer Christopher Gutknecht (you can also catch a conversation with him here).

First off, the three major avenues for aligning Shopping campaigns to business objectives are as follows: custom label, conversion value, and audience. You can also learn more about these options here.

While Shopping feeds have a series of standard attributes available, custom labels allow you to inject effectively any business data into your campaigns, where it can then be used in measurement, structuring, bidding, and budgeting.

Conversion value

Conversion value is about what you track, and how. Revenue via conversion pixel is the classic, but you can also modify the pixel to track other things like gross profit (revenue minus Cost of Goods Sold). Alternately, you can use offline imports to get to more precise measurements like deeper contribution margin layers (e.g. revenue minus COGS and variable transaction costs). Google also offers no-code solutions for modifying conversion value, written about in more detail by Google Ads expert Frederick Vallaeys.

Audience

Audience is a critical dimension of profitability, since there is no such thing as an average customer and the value, and the incrementality of advertising is highly dependent on audience. As Karen Sauder, a Google President, has written: “Measurement and ad platforms must be connected, and teams must work together from data that’s unified around audiences, rather than channels.”

Finally let’s quickly describe some of the profit metrics your might measure instead of revenue.

Product margin

Product margin: This is the easiest way to bring campaigns closer to ROI. It is a relatively small task to bring margin into your feed via custom label (depending on your business). The drawback is that you will be optimizing based on the margin of the single product that is clicked, rather than the basket that is bought – and these two can be quite divergent, quite often.

Order profit

Order profit: This means measuring profit the actual transaction instead of just the product that was clicked. This is more ambitious and technical to configure, but it is also a much more realistic picture of what is occurring at the intersection of the channel and your website. With the right setup, you can gain insight into buyer behavior, product substitution, and more – as I’ve discussed here.

Customer lifetime value

Customer lifetime value: This is the modelled profit of a customer over time. It’s a metric that was popularized in subscription-based business models with lower levels of complexity and higher levels of predictability than what is typically seen in ecommerce. Simplistic approaches are to be avoided. It is therefore at the cutting edge of ecommerce measurement, and might not be feasible or recommended for every merchant. However it is often regarded as the Holy Grail of optimization.

Final word

Without question, revenue growth is a highly valuable business goal, and depending on your business model and what “phase of life” your company is in, it can be the number one goal. That said, currently the large majority of merchants optimize based on revenue with ROAS targets as a proxy for profit. In doing so, they are leaving a share of both current profit and future returns on the table. This is due to a lack of accuracy, as well as the goal incoherence of trying to simultaneously maximize both volume and efficiency.

Nearly any movement toward measuring and optimizing on profit is tendentially positive because this will result in increased clarity about the true performance of the channel, and because profitability is a vital trend-setting factor for the health of any company.

As ad channels like Google Shopping become increasingly hands-off in nature, the true competitive advantage will not be in bidding itself – because this will function in an effectively identical manner for all advertisers – but rather in being able to determine the actual ROI more realistically than your competitors.

Beyond the profitability of single transactions, the ever-increasing battle for sales means that merchants will have to ask themselves which customers they want to win and how much those customers are worth to them. This is why metrics like CLV are attractive even if currently quite demanding to deliver. The real magic trick will be to determine how much budget to allocate to which channel (and when), considering a multitude of factors like incrementality, the response of a given channel to budget increases, and the profitability (whether CLV or otherwise).

This marketing mix model challenge is perhaps partially solved by the strategy of ad platforms like Google to de-channel themselves, as seen in campaign types like Smart Shopping or Performance Max, where the maximum liquidity is achieved by bringing all ad inventory into one big stew. However, there will always be the incentive of those platforms to keep your budget occupied in their playground, rather than that of competing platforms. Independent attribution solutions could therefore be more important than ever, insofar as possible within the increasingly complex privacy landscape.

I’ll end with a quote:

“We wanted to grow to get market share. But it was always important to me that this was sustainable growth. It’s an interesting topic, because you can always buy revenue, right? You can always buy conversions. Revenue growth doesn’t really say much because if you throw money at it, you can always get money back.”

– Marika Baltscheffsky, CMO of MEDS.se (listen here)

You can also listen our “Growing Ecommerce” podcast where I explore the topic in depth: