Google Ads benchmarks for Ecommerce

Compare your campaigns against European ecommerce benchmarks for CPC, conversions, ROAS, and more – and learn if rising costs are your problem, or the market's.

Welcome back! Your industry data is ready.

Analyze deep-funnel metrics including ROAS and conversion trends across Europe.

Data from the

full time range

Additional charts for

deeper insights

Filter the data

by Industry

Monthly Newsletter

with top trends

Data from a big amount of ad campaigns (incl. 4000+ PMax campaigns)

Built on €450M+ annual ad spend showing real market patterns

Data from a big amount of ad campaigns (incl. 4000+

PMax campaigns)

Tracks Search, Shopping and PMax shifts - always up to date

and filterable

Built on €450M+ annual ad spend showing real market patterns

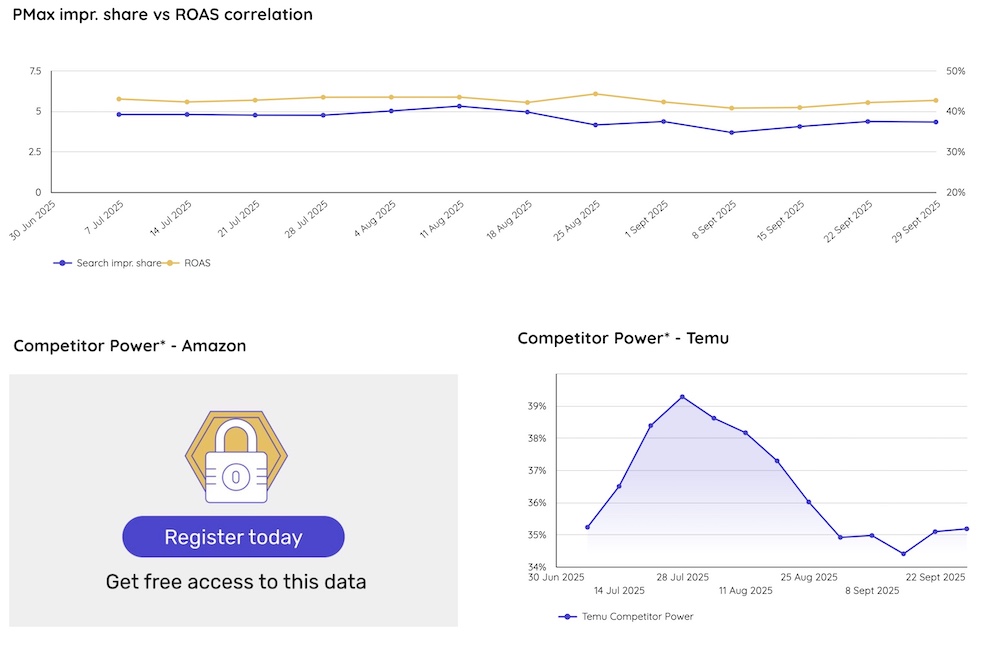

Observe movements of big auction players to stay ahead of the competition and apply adaptive strategies.

Observe the CPC dynamics in Google Ads for the Ecommerce and Retail verticals accross Europe.

Summary

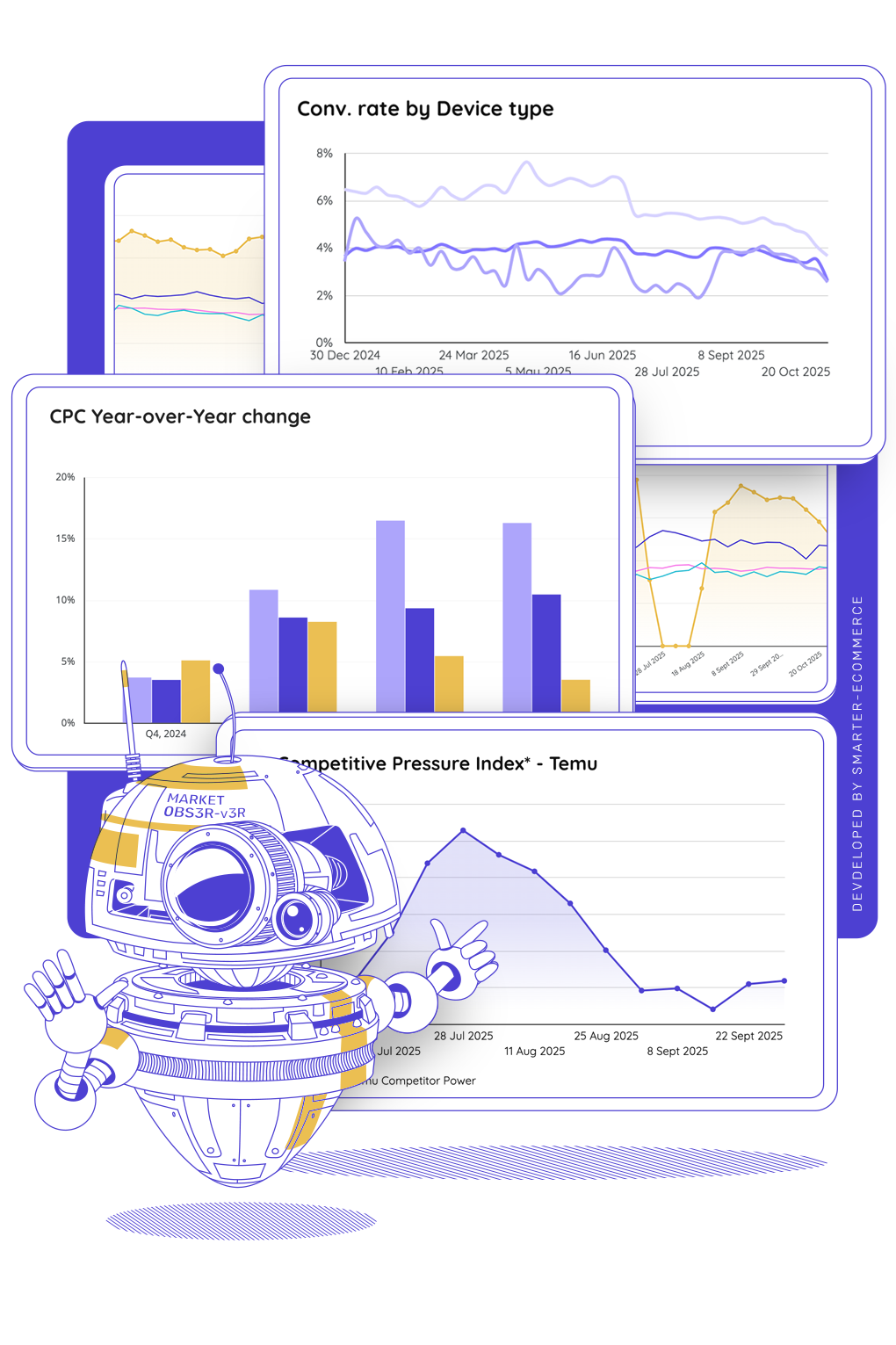

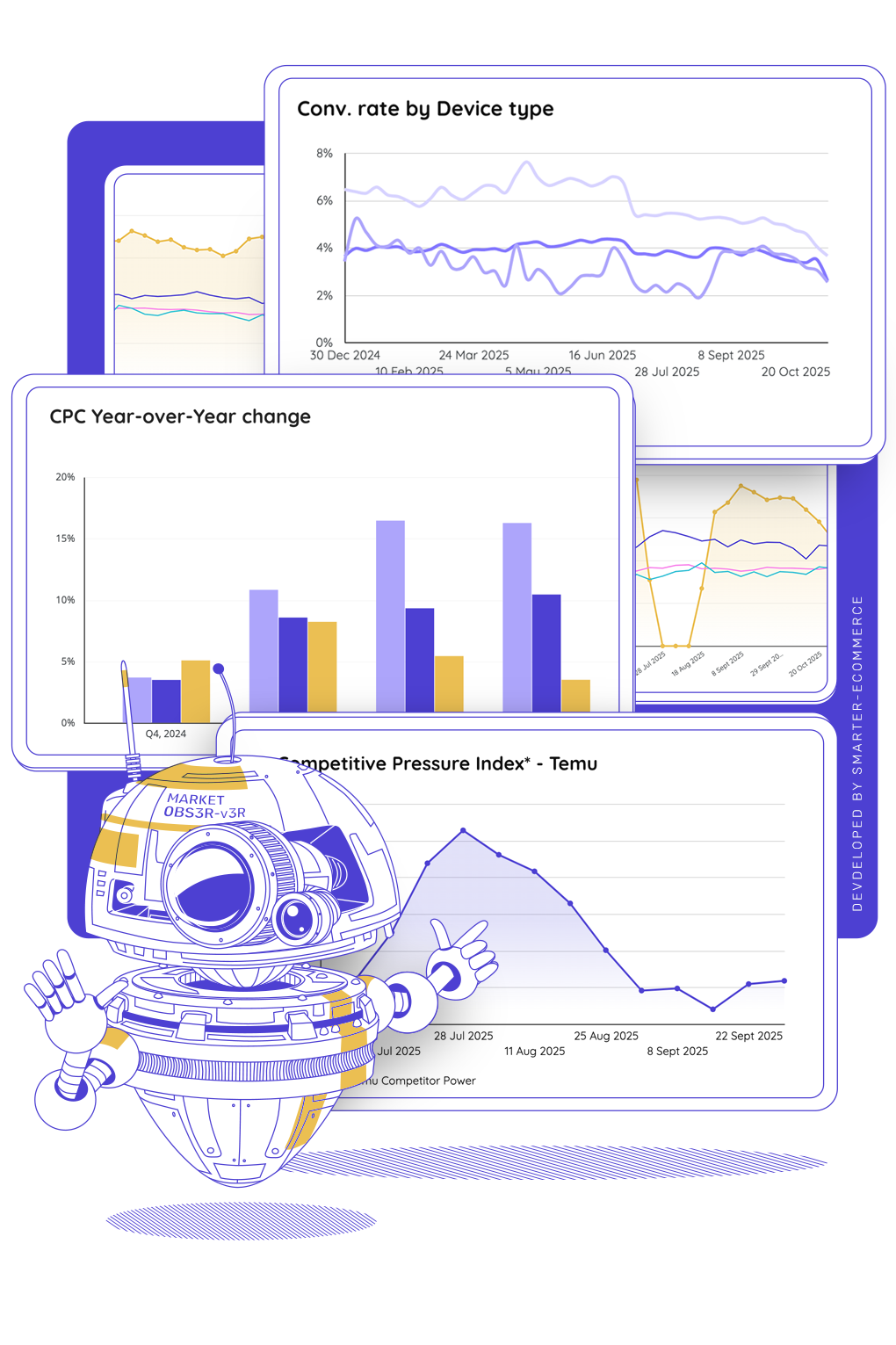

Shopping exhibits the highest Year-over-Year growth in CPC, peaking near 17% in Q2 2025, while Search shows the lowest CPC increase, falling from roughly 5% to nearly 0% by Q1 2026. Despite this surge, Shopping remains the lowest-cost channel, whereas Search and Performance Max consistently maintain higher costs between €0.35 and €0.42 throughout the period.

Source of data:

Smarter Ecommerce

Last Updated: February 16, 2026

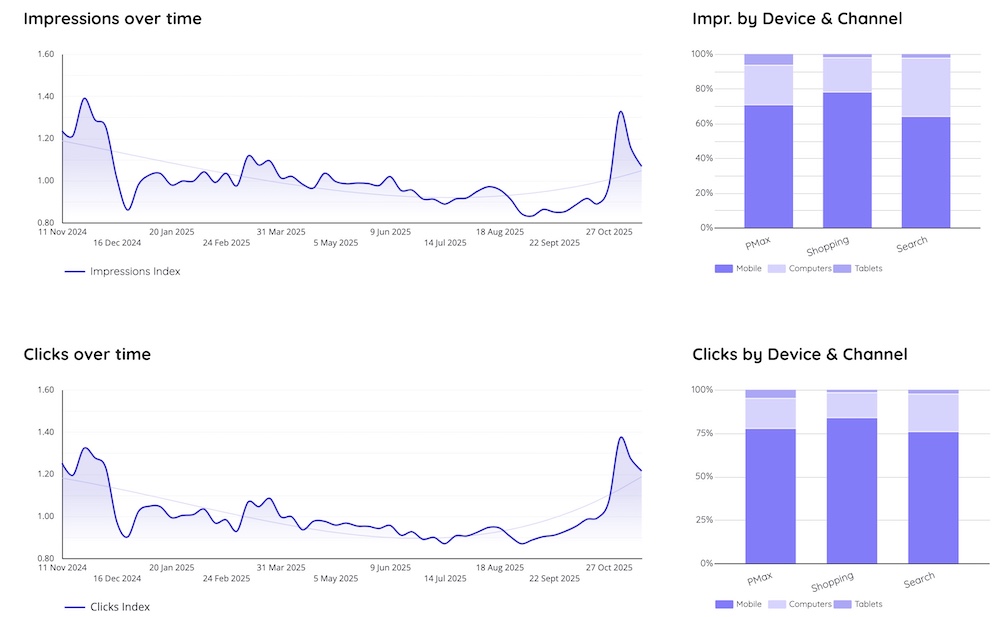

Track Google Ads impressions, clicks, conversions, and cost across Search,

Shopping, and Performance Max - catch problems before they hurt your budget or identify wins to scale.

Summary

Shopping campaigns show a marked efficiency shift, with year-over-year impressions falling nearly 18% in Q1 2026 while conversions grew by approximately 20%. In contrast, Search campaigns faced a sharp downturn, dropping from early highs to a 22% decline in conversions by Q1 2026, indicating a significant divergence in channel performance stability.

Source of data:

Smarter Ecommerce

Last Updated: February 16, 2026

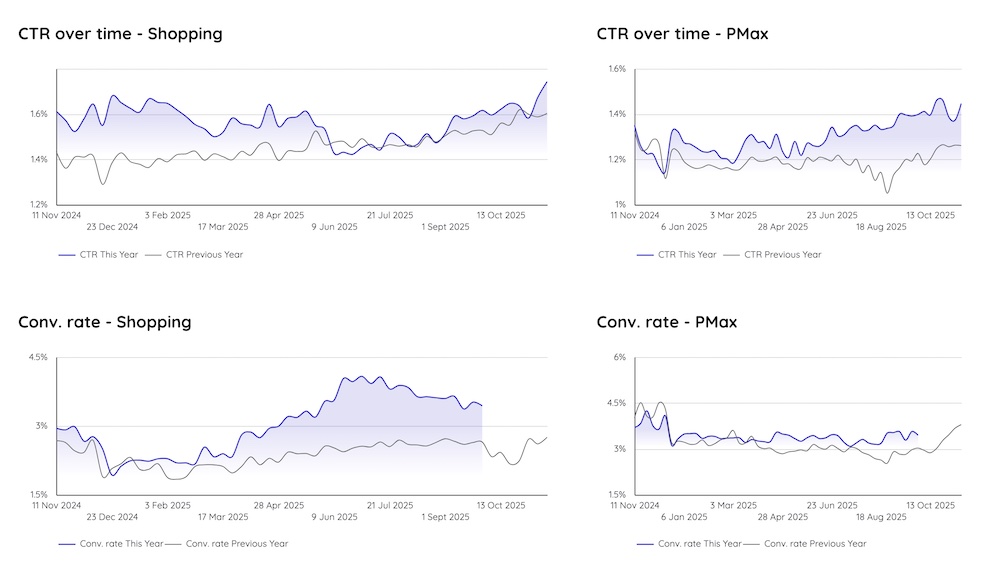

Monitor CTR, conversion rates, ROAS, and AOV by campaign type and device and see which channels

drive profitable growth and where efficiency is slipping.

Summary

Search campaigns demonstrate strong momentum with Click-Through Rates surging from 10.5% to a peak of over 16.5% by late November. This efficiency gain is mirrored in the Median ROAS, which climbed steadily from 5.2 to nearly 7.0 by year-end. Additionally, computers consistently outperform mobile phones, maintaining a superior conversion rate of approximately 7% compared to roughly 4%.

Source of data:

Smarter Ecommerce

Last Updated: February 16, 2026

Register for FREE full access on the PRO charts below, including industry benchmarks & competition insights.

Data from the

full time range

Additional charts for

deeper insights

Filter the data

by Industry

Monthly Newsletter

with top trends

We take your privacy seriously. Read our privacy policy.

The Market Observer analyzes data from €450M+ annual retail ad spend across Europe, covering thousands of active Google Ads campaigns. Industry verticals include Fashion, Electronics, Home & Garden, Health & Beauty, Sporting Goods, and more—giving you relevant benchmarks for ecommerce performance.

We refresh the data every week, so you're always seeing current market trends, not outdated snapshots. Weekly updates ensure you can spot shifts in CPCs, conversion rates, and competitive activity before they significantly impact your campaigns.

We track Search, Shopping, and Performance Max campaigns separately, so you can compare performance across all three channels and understand which delivers the best results for your goals.

smec’s benchmark tool helps you make smarter, faster Google Ads decisions by showing whether performance changes are campaign issues you control or market-wide trends you need to adapt to. Here's how to use the data:

a. Benchmark your Google Ads performance against Industry standards

Compare your Google Ads metrics like CPC (cost-per-click), CTR (click-through rate), conversion rates, ROAS (return on ad spend), and AOV (average order value) to European ecommerce benchmarks. If your metrics are below average, you know where to focus optimization efforts.

b. Diagnose Google Ads Problems Faster with Market Context

When conversion rates or ROAS drop, check if smec’s benchmark tool shows the same decline across Search, Shopping, and Performance Max campaigns. If yes, it's likely due to larger forces like seasonality, competitive pressure, or changes in demand – adjust expectations and strategy. If no, it's likely a campaign-specific issue – audit Google Ads search terms, landing pages, bids or assets.

c. Contextualize Google Ads budget decisions to Stakeholders

Use smec’s benchmark tool data in Google Ads performance reports to show that, for example, rising CPCs or declining ROAS aren't isolated to your campaigns when the entire ecommerce market is experiencing the same trends. This turns defensive conversations into strategic planning backed by real benchmarks.

d. Identify Google Ads Budget Reallocation Opportunities

If you're underperforming a growing channel, there could be a chance to invest more. Looking at your CPC development compared to the markets could help get a first idea of whether you can do so profitably.

e. Plan Google Ads Seasonal Adjustments Proactively

Look at past data in smec's benchmark trends to anticipate Google Ads CPC spikes, conversion rate changes, or impression share shifts during peak retail periods (Black Friday, Q4). Adjust budgets and ROAS targets ahead of time instead of reacting after the fact.

f. Validate Google Ads optimization impact

After making Google Ads campaign changes, like refreshing ad creative, updating landing pages, or adjusting bid strategies, compare your performance trends to our tool’s benchmarks over the following weeks. If you're closing the gap or outperforming, it’s an indicator that your optimizations were effective, and are not merely due to market changes. If not, try different tactics.

Core metrics like CPC trends, funnel data, and median Google Shopping impr. share are completely free with no signup required. To unlock industry-specific filtering (Fashion, Electronics, etc.) and full historical data, register for PRO access above. It's free to sign up.

Absolutely. You're free to reference Market Observer data in internal reports, client presentations, or strategy decks. Just credit smec as the source when sharing externally.

Google provides benchmarks, but they're often generic and limited. The Market Observer focuses specifically on ecommerce and retail with deeper competitive insights, like Amazon's impression share and Performance Max efficiency trends, that Google doesn't surface in their dashboards.

We're constantly expanding vertical coverage. If your industry isn't available yet, register for PRO anyway, we'll notify you when we add your vertical, and the core market-wide metrics are still valuable for spotting broader trends.

Yes. Core funnel and performance metrics, median Shopping impr. share, and market trends are 100% free with no credit card required. PRO features (industry filtering, extended historical range, additional charts) require a simple registration, but it's still free.

This tool is built for PPC managers optimizing Google Ads campaigns, marketing managers justifying ad budgets to leadership, agency professionals benchmarking client performance, and ecommerce/retail executives making strategic decisions based on competitive intelligence.

We've crunched the numbers based on nearly two thousand Google Ads accounts for ecommerce.