Market trends: The compass for your ad strategy

Stay ahead of the competition with our up-to-date market insights to support your growth

In a nutshell:

Back in the first weeks of lockdown, we had an impulse — let’s create a Market Observer to support retailers & advertisers navigate through tough times of massive changes. It’s 2024 now and the dynamics of changes is at a peak all the way!

Utilizing Google Ads market trends data is like having a GPS for your Google Ads strategy — it keeps you on the right path, helps you navigate obstacles, and ensures you reach your destination more efficiently. The best part: it’s free.

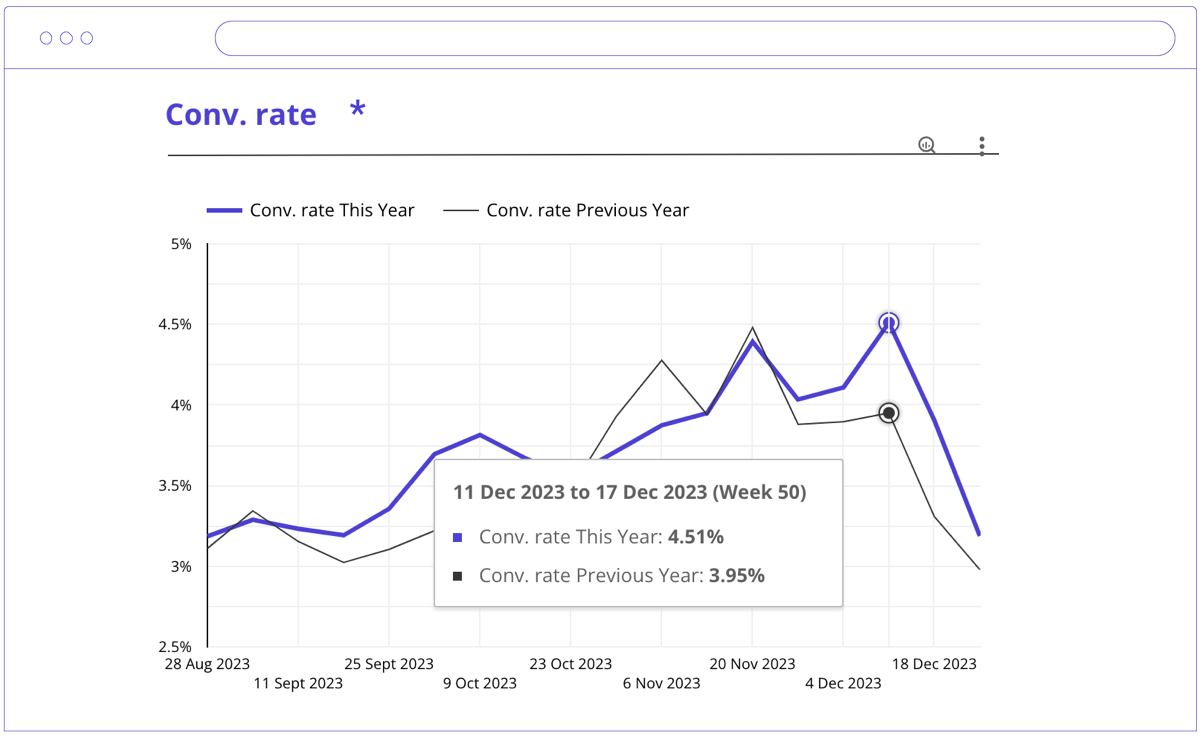

The data allows you to observe year-over-year trends, helping you anticipate and prepare for shifts in the broader advertising landscape. This foresight can be crucial in maintaining consistent performance.

Avoid pitfalls: detect issues, such as rising costs or declining click-through rates. Recognizing these early helps you pivot your strategy before it impacts your performance significantly.

Curious about PMax vs Standard Shopping performance in the trends? We’ve got it!

Use the data to make informed decisions that improve your overall Google Ads strategy. Whether it’s optimizing for better click-through rates or adjusting your cost per conversion, these insights help you stay competitive in a crowded marketplace.

Example: Year-over-year comparisons help you understand consumer behaviour and prepare for unexpected peak times, ready to allocate budget when time comes.

Data from the latest time range

Filter by advertising channel type

Additional charts for even more insights

We take your privacy seriously. Read our privacy policy.