Subscribe to join thousands of other ecommerce experts

Listen closely. Hear that?

It’s the sound of silence of the Google Shopping auction without its loudest voice.

In an unprecedented move, Amazon has gone completely silent, pulling its ads across the globe and leaving a colossal void in its wake.

This creates both a massive opportunity and a dangerous trap. It’s a potential gold rush for cheaper clicks and new customers, but it also raises critical questions: Is this a temporary glitch or the new reality? And how do you seize the opportunity without falling into the pitfalls?

Keep reading, because we’re unveiling a powerful way for you to see exactly how these shockwaves are impacting your industry in real-time.

Table of Contents

Update: Amazon’s back – but only internationally

Editor’s note (August 23, 2025)

As of August 23, 2025, Amazon has reactivated its Google Shopping Ads across all international markets — with one major exception: the US. The advertising outage lasted exactly one month, which gives more weight to the theory that Amazon was running a massive incrementality test.

Mike Ryan, our Head of Ecommerce Insights, summed it up best on LinkedIn:

“Amazon appeared as an account-level competitor for three quarters of European advertisers OVERNIGHT.”

This fast-and-furious comeback means the brief vacuum Amazon left behind is already being filled in most markets. However, the US Shopping landscape is still Amazon-free — a fascinating development in its own right.

Does this imply the US failed the test? Is Amazon done with Google Shopping in its home market? Too early to say. But you better believe we’re tracking it.

👉 Check the smec Market Observer for real-time updates on Amazon’s presence across 20+ Shopping domains.

Amazon exits Google Shopping

Raw Data Table

The following table contains the complete dataset used for the visualization above.

| Day | Amazon.de | Amazon.co.uk | Amazon.com | Amazon.es | Amazon.fr | Amazon.in | Amazon.it | Amazon.nl | Amazon AU | Amazon CA | Amazon MX | Amazon.ae | Amazon.co.za | Amazon.com.be | Amazon.ie | Amazon.pl | Amazon.sa | Amazon.se | Amazon.sg | Amazon公式サイト |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 14-Jul | 41% | 63% | 62% | 29% | 39% | 64% | 35% | 24% | 35% | 35% | 58% | 77% | 33% | 56% | 54% | 16% | 35% | 39% | 58% | 47% |

| 15-Jul | 40% | 60% | 65% | 32% | 39% | 54% | 34% | 23% | 19% | 35% | 73% | 79% | 32% | 52% | 55% | 14% | 37% | 39% | 42% | 50% |

| 16-Jul | 40% | 63% | 66% | 33% | 40% | 52% | 35% | 23% | 20% | 59% | 71% | 79% | 33% | 55% | 57% | 14% | 36% | 38% | 41% | 50% |

| 17-Jul | 38% | 62% | 65% | 33% | 41% | 56% | 36% | 24% | 20% | 61% | 70% | 79% | 33% | 57% | 60% | 14% | 36% | 41% | 43% | 51% |

| 18-Jul | 37% | 58% | 61% | 33% | 42% | 57% | 37% | 24% | 19% | 75% | 70% | 79% | 35% | 56% | 59% | 14% | 38% | 45% | 42% | 53% |

| 19-Jul | 36% | 57% | 65% | 33% | 41% | 55% | 36% | 25% | 19% | 74% | 67% | 50% | 53% | 56% | 59% | 13% | 13% | 41% | 46% | 72% |

| 20-Jul | 35% | 53% | 64% | 33% | 39% | 51% | 37% | 28% | 21% | 59% | 67% | 79% | 50% | 60% | 60% | 14% | 14% | 43% | 44% | 72% |

| 21-Jul | 37% | 55% | 60% | 32% | 45% | 54% | 38% | 27% | 23% | 59% | 73% | 77% | 47% | 56% | 60% | 15% | 34% | 43% | 42% | 57% |

| 22-Jul | 34% | 43% | 24% | 29% | 37% | 52% | 33% | 24% | 24% | 59% | 22% | 68% | 45% | 55% | 48% | 13% | 35% | 38% | 41% | 51% |

| 23-Jul | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| 24-Jul | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| 25-Jul | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| 26-Jul | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| 27-Jul | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| 28-Jul | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| 29-Jul | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| 30-Jul | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| 31-Jul | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| 1-Aug | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| 2-Aug | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| 3-Aug | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| 4-Aug | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

⚠️ This chart shows Amazon’s July 2025 exit.

Spoiler: they’re back (everywhere but the US).

See real-time updates in the smec Market Observer.

In a move that’s sending shockwaves through the ecommerce world, Amazon has abruptly and almost completely shut down its Google Shopping ads across the globe.

This isn’t a gradual retreat; it’s a sudden, dramatic exit that is already reshaping ad auctions for retailers everywhere.

As our Head of Ecommerce Insights, Mike Ryan, puts it, this move is “colossal”. The last time we saw an ad stop this significant from Amazon was during the acute phase of the pandemic lockdowns in 2020, which coincided with a nearly 20% drop in average Cost-Per-Click (CPC).

A sign of things to come?

Immediate impact: CPC drop?

Not so fast.

When a big spender like Amazon exits the auction, you’d think CPCs would nosedive. That’s what happened during the 2020 lockdowns—CPCs dropped by around 20% when Amazon briefly pulled back.

So, same story now, right? Not quite.

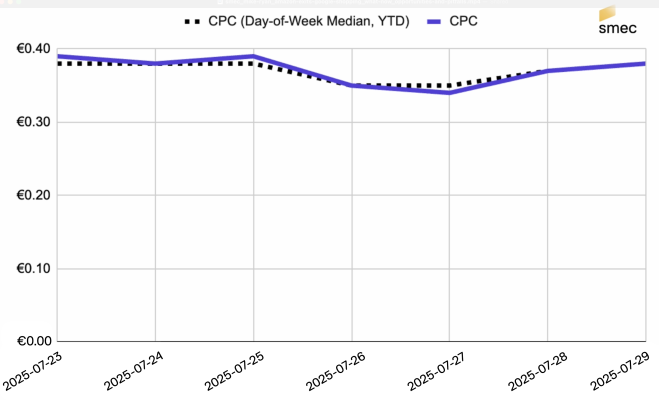

📉 CPCs are holding steady

Our current data shows median CPCs haven’t really budged. They’re tracking right along with year-to-date averages.

👀 Engagement is flat, too

Click-through rates and impression share? Also surprisingly stable. No major shifts, no fireworks.

So what gives?

🟢 Our take: Other advertising whales have already swooped in and soaked up the freed-up inventory.

We saw the same playbook after Temu left earlier this year. Giants like Etsy and eBay stepped up fast and gained the most.

And now? It’s déjà vu. We’re likely seeing a similar redistribution of share at the top, but we’re still watching the data roll in.

Source: smec Market Observer

Temu steps up: Competition heats up post-Amazon in Google Shopping

Since Amazon exited Google Shopping, Temu’s footprint in the auction is growing fast. According to our data, the share of advertisers facing Temu as a competitor in Europe jumped from 60% to 75%. That’s a big leap and it happened practically overnight.

As Mike Ryan put it on Twitter: “Temu LOVING Amazon’s exit”. Expect more aggressive bidding and stiffer competition in categories Temu loves, especially low-price, high-volume segments.

The billion-dollar question:

Why now?

The answer to that will determine how long this new landscape might last. While Amazon hasn’t issued a formal statement, several theories are circulating:

- A massive incrementality test: Amazon could be running the ultimate test to measure the true, incremental value of its Google Ads spend. By turning them off, they get a clean look at how many customers find them directly anyway.

- High-stakes negotiations: This could be a power move to gain leverage in negotiations with Google. With billions in ad revenue at stake, pulling the plug is a surefire way to get attention.

- A pivot to their own ecosystem: With over half of product searches already starting on Amazon, they may be doubling down on their own advertising platform. Why fund a competitor when you can force brands to spend more within your own walled garden?

Either way, what matters to you is how this sudden shift impacts your current ads strategy right here, right now.

Your playbook for the post-Amazon auction

With Amazon out, the Shopping Ads landscape just shifted and guessing your way through it won’t cut it. You need a data-driven plan to navigate the new auction dynamics and protect your margins.

Here’s where to start:

🔍 1. Check your actual auction, not the headlines

Sure, CPCs look stable on the surface. But your auction might tell a different story.

Open up your Auction Insights report and see who moved in. The new top dogs might play by totally different rules and that impacts everything from bid pressure to budget efficiency.

💡 Pro tip: Don’t just chase CPCs. Look at profitability and ROAS across segments to get the full picture.

📈 2. New spend? Make sure it pays

If your budget-limited campaigns are suddenly spending more—great, right? Maybe.

But more spend doesn’t always mean more value. If that traffic isn’t converting profitably, you’re just lighting cash on fire.

✅ Track how new clicks perform vs. your usual benchmarks

✅ Watch ROAS and conversion quality like a hawk

✅ Don’t let volume distract you from efficiency

🛡️ 3. Lock down your brand terms

Rivals are circling. Some will get aggressive, even bidding on your brand terms to scoop up high-intent traffic.

Now’s the time to:

- Strengthen your brand defense setup

- Keep an eye on competitors’ moves

- Track the broader market

To make that last one easier, we’ve added a new free feature to the smec Market Observer. You can now monitor Amazon’s Shopping Ads activity (or absence) across 20+ domains. The feature will be updated regularly, and a real-time view is just around the corner.

A look ahead

Amazon is out, but the ripple effects are just starting.

We’re likely looking at:

- A new competitive baseline with marketplaces like eBay gaining ground

- Amazon doubling down on its own retail media empire

- More volatility as big players test their limits

One thing is clear: the principles of sound performance marketing—analyzing your own data, understanding your profitability, and adapting to competitive shifts—are more critical than ever.

Know your numbers, protect your margins, and stay alert.

🧭 Don’t guess. Steer with data.

Your account data only shows part of the picture. That’s why we built a new feature inside the free smec Market Observer.

Track Amazon’s presence across 20+ domains and see how it’s shaping CPCs in your industry.