Subscribe to join thousands of other ecommerce experts

Article updated 2026-01-14, 04:15 pm.

To build a Performance Max product segmentation strategy that combines brand, category, price range, performance tiers, and more, you must move beyond simple historical metrics (like Sales Volume and ROAS) and adopt Multi-Dimensional Product Segmentation.

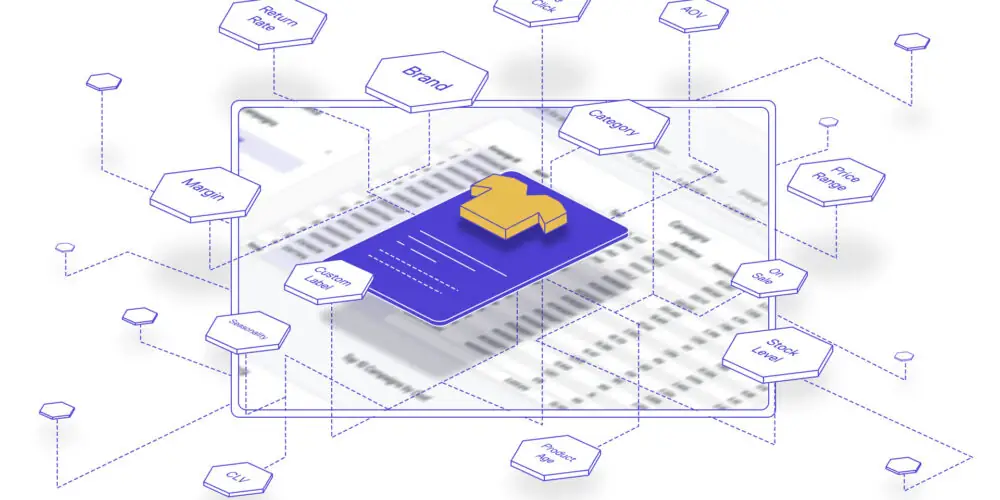

This approach uses automation to layer diverse data points—such as profit margin, stock availability, seasonality, competitive pricing—creating granular "Dynamic Segments" rather than broad buckets.

By integrating these specific attributes (e.g., Brand + High Margin + Low Visibility), advertisers can force Google's PMax algorithms to align with complex business goals. This ensures budget is allocated not just to best-sellers, but to "hidden champions" and strategic tiers that drive long-term profitability, overcoming the "strategic blindness" of standard AI automation.

A key challenge with Google’s Performance Max (PMax) is its broad-brush approach to product catalogs. In its quest for quick wins, PMax prioritizes best-sellers, sidelining a vast array of products with less performance data that might still align more closely with your most critical business objectives. This can result in campaigns that boost immediate sales but fail to build long-term profitability.

How do we address this? Product segmentation.

Table of Contents

What is Product Segmentation?

At its core, product segmentation means dividing a vast product catalog into smaller, meaningful segments based on distinct characteristics. These characteristics most often include: brand, product type and number of conversions.

When done right, product segmentation allows for a more strategic approach to marketing. This ensures that each product group is promoted in a way that resonates with the right business goals. Ultimately leading to more effective marketing strategies.

But given the way Performance Max has been designed, “doing it right” is exactly the issue.

What are the issues with Product Segmentation in Performance Max?

For starters, Performance Max offers you a very limited amount of control levers to steer the Google Ads auction.

Out-of-the-box, your only tangible options are Returns on Ads Spent (ROAS) and budget adjustments. However, relying solely on ROAS falls short of meeting the nuanced demands of scaling a business. Or achieving specific targets such as profitability or boosting Customer Lifetime Value (CLV).

Besides limiting the retailers’ control over their product lineup to ROAS-level adjustments, PMax suffers from a few more shortcomings that complicate efficient product segmentation strategies. If you read our State of PMax report, you are likely aware of them.

To summarize them briefly:

- Lack of granular control: PMax and similar campaign types restrict advertisers to setting broad campaign goals and adjusting budgets. All without the ability to make detailed product-level adjustments.

- Data scarcity: PMax lacks detailed data about your business beyond basic sales and efficiency metrics. This hinders precise product segmentation and campaign customization for specific business goals.

- One-size-fits-all approach: Performance Max follows the path of least resistance, focusing on top-selling products regardless of their strategic importance or profit margins. This can lead to a lopsided campaign that overlooks potential hidden champions in the product catalog.

In other words: Google’s AI is a powerful business engine, but it’s strategically blind to your business needs. In its quest to achieve the fastest and easiest wins, they completely ignore any strategic goals a retailer might have – whether that’s long-term growth, pushing specific product lines or ramping up profitability.

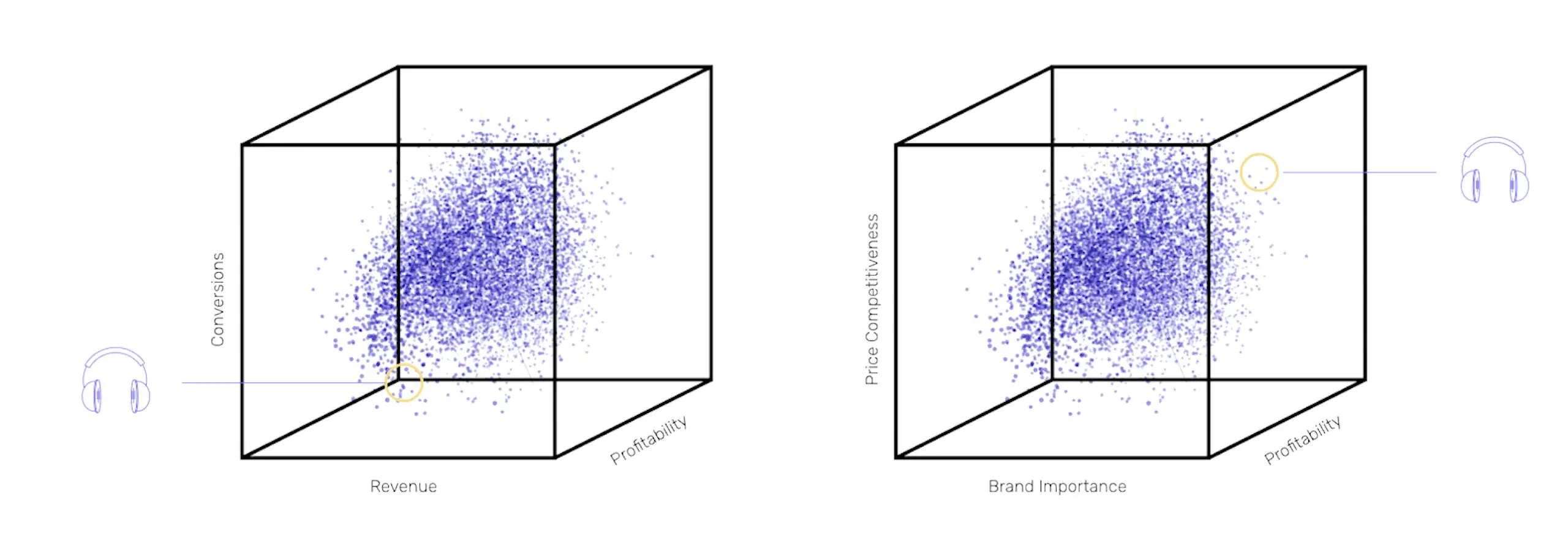

Ideally, product segmentation counteracts these issues. But here’s the thing: the traditional way of segmenting products tends to categorize product catalogs in a very broad, two-dimensional way. Mainly driven by how well a product sells or how cost-effective it converts clicks into sales.

The problem with that?

What is two-dimensional Product Segmentation?

As its name suggests, two-dimensional product segmentation mainly focuses on two metrics when categorizing product catalogs:

- Sales Volume: This measures the quantity of products sold. It identifies which items are the most popular or in-demand within a given time frame.

- Efficiency (ROAS): This gauges the cost-effectiveness of advertising efforts, highlighting which products generate the most revenue relative to ad spend.

What are the issues with two-dimensional Product Segmentation?

While Sales Volume and Efficiency (ROAS) are crucial elements of any solid product segmentation strategy, relying solely on these two metrics causes several issues:

- Reliance on past performance: Segmenting products based on Sales Volume and Efficiency is heavily dependent on historical data. This poses challenges when pushing new or niche items, as they don’t have any historical data yet.

- Conflated metrics: Sales Volume and Efficiency are closely linked together. The problem with that? Marketers are segmenting products in even fewer dimensions than this method suggests. This leads to a narrower, less varied categorization of products.

- Missed opportunities: Two-dimensional segmentation often neglects significant factors that might highlight a product’s strategic importance to the business or its appeal to specific consumers.

Two-dimensional product segmentation methods tend to focus on immediate performance indicators. All while overlooking the potential of products that might not be current top-sellers but have a high chance to contribute to the overall bottom line.

consider a product with high revenue and ROAS. While this may sound good, it is important to also consider the profit margin of the product. For instance, what if there is a new version of the product that has not been sold yet but could attract more shoppers than the previous version with a lot of conversion data?

In this case, looking at one or two metrics alone is not enough.

Luckily, there is a superior way for retailers to incorporate a vast amount of diverse metrics for a more robust segmentation strategy.

| Metric | 2D-Segmentation | Implications |

| Sales Volume | Yes | Identifies top-performing products, useful for quick wins. |

| Efficiency (ROAS) | Yes | Aims to make advertising spend cost-effective. |

| Product Attributes | No | Leads to a disconnect between product offerings and market demands. |

| Consumer Behavior Insights | No | Misses targeted engagement and growth opportunities. |

| Market Trends | No | Misses emerging demands and market shifts. |

| Profit Margin | No | Affects overall profitability by not prioritizing high-margin products. |

| Inventory Levels | No | Risks promoting out-of-stock or overstocked items. |

| Competitiveness | No | Ineffective pricing and differentiation strategies. |

What is multi-dimensional Product Segmentation?

Multi-dimensional product segmentation goes beyond relying solely on ROAS and Sales Volume by segmenting your product catalog based on several more crucial business metrics. Depending on your business strategy, these factors may include:

- Traditional Ad Metrics: ROAS, conversions, etc.

- AOV: Focus on products that increase cart values.

- Brand Push: Highlight in-house or specific third-party brands.

- Competitive Pricing: Promote attractively priced items.

- Profit Focus: Aim for sales that maintain profitability.

- Stock Management: Advertise products with ample stock.

- Warehouse Preference: Prioritize products from specific locations.

- Key Product Lines: Feature signature product ranges.

- New Releases: Push the latest products or clear old inventory.

- Seasonal Relevance: Spotlight season-specific items.

How to segment in

multiple dimensions

But how does multi-dimensional product segmentation work exactly?

To start off, it’s important to understand that different online retailers face unique challenges in the digital advertising space. Not one business is the same, that’s why multi-dimensional product segmentation considers the specific business goals of online retailers.

Depending on the individual goals, this might involve identifying products that have:

- Strategic Importance: Products crucial to the retailer’s brand identity or those with higher margins.

- Niche Appeal: Products with unique features or appeal to specific customer segments or needs.

- Seasonality and/or events: Products that are particularly relevant during specific seasons or in response to upcoming events. For instance, prioritizing skiing equipment during the winter season or camping gear in the lead-up to summer.

1. Why is this important?

By focusing on products that resonate with the brand’s business needs and customer expectations, businesses can foster stronger connections with their audience, driving loyalty and repeat business. Multi-dimensionality helps marketers align product promotion and business goals for sustainable growth and a competitive advantage.

Multi-dimensional product segmentation not only enhances the efficiency of advertising campaigns but also ensures that every marketing dollar contributes to long-term brand development and profitability.

2. Multi-dimensionality with data-driven insights

Once the unique business goals of online retailers are set, multi-dimensional product segmentation focuses on giving automated campaign types, like Google’s Performance Max, a serious data boost. Turning data deserts into lush, insightful advertising landscapes.

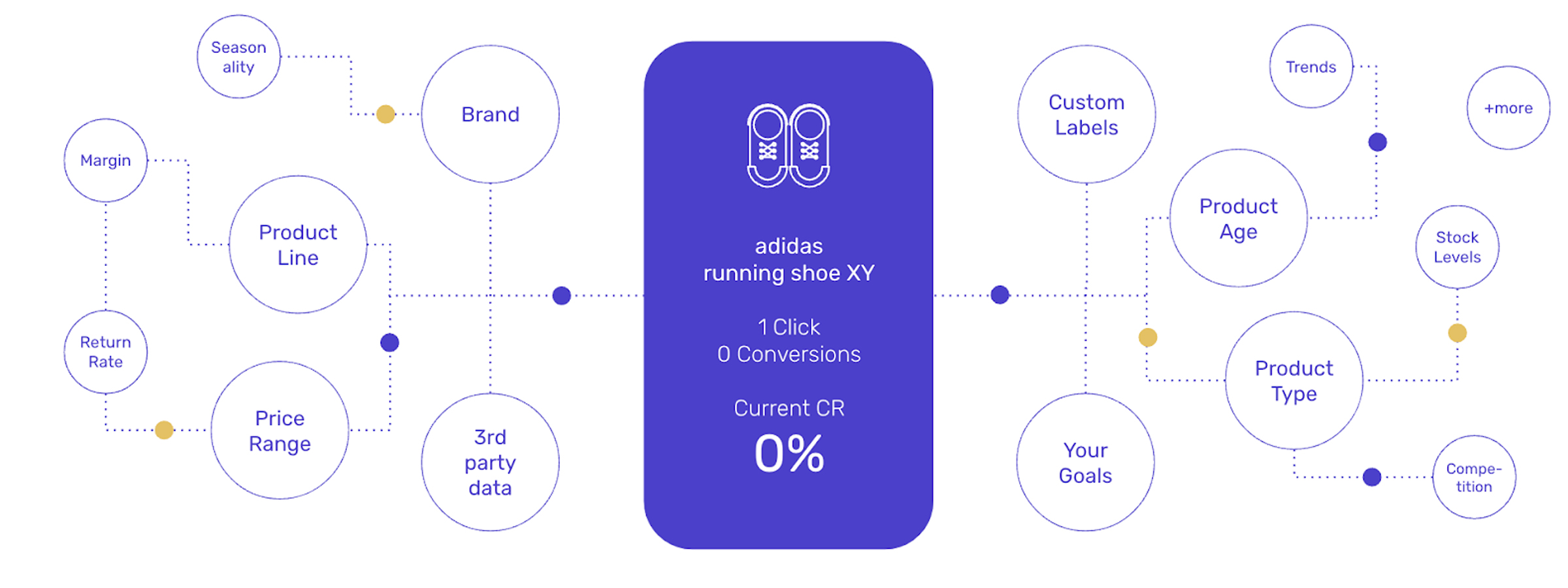

Unlike 2D-segmentation, multi-dimensionality goes beyond just looking at the big picture; instead, it looks at each product within the catalog individually to help retailers identify the best campaign opportunities.

With multi-dimensional segmentation, retailers are able to feed algorithms with superior business data ranging from:

- First-party data: This includes sales figures, customer engagement metrics, and other internal data that offer insights into product performance and customer preferences directly from the retailer’s perspective.

- Second-party data: Often obtained through partnerships, this data provides additional market insights and benchmarks. Offering a comparative view that enriches the retailer’s understanding of their position within the industry.

- Third-party data: External market research, consumer behavior studies, and trend analyses contribute a broader perspective. This overarching market dynamics that could influence product performance.

3. Uncovering product categories

After processing these pieces of data, multi-dimensional product segmentation can help retailers uncover various product categories that might have been previously underexplored. Or find categories that haven’t been fully leveraged yet. These categories can include:

- Specialized products: Unique or specialized items hidden in the longtail that cater to specific customer interests or needs.

- High-margin items: Products that offer a higher profit margin but may not have the highest sales volume. Making them valuable for targeted promotions.

- High B2B share: Product types that have demonstrated significant success in driving B2B conversions.

These product categories give online retailers a superior understanding which products should receive more focus, budget, and exposure. All of this is based on the products’ strategic importance, potential for growth, or alignment with current market trends and consumer behavior.

On top of that, retailers can achieve a better understanding as to which products are not only performing well currently, but also have the potential to drive sustainable growth in the long-run. Allowing them to invest in areas with the highest potential for return and maintain a competitive edge in the market.

4. Finding the hidden champions

With multi-dimensional product segmentation, retailers are able to incorporate sophisticated AI models in their strategy that help them compare their top-performing products and their shared characteristics – like brand, seasonality, margin, trends, etc. – to pinpoint similar but underrepresented products.

These products often possess a strong potential for conversion, provided they are given the opportunity to be highlighted from the more dominant items:

- Niche specialties: Products that cater to specific, often underserved segments of the market. These could include items with unique features, specialized uses, or that appeal to particular hobbies or interests.

- Strategic brand items: Products that are crucial to the retailer’s brand identity or strategic goals, such as proprietary or flagship products, even if they haven’t been top sellers historically.

- Value products: Items that offer high value to customers, either through competitive pricing or superior features, but haven’t been adequately promoted or positioned.

For instance, through this analysis, an online retailer specializing in outdoor gear might uncover that certain camping tents, although not currently among the top sellers, share key attributes with best-selling items. Such as high customer ratings, compatibility with popular hiking gear, and preferred materials. These tents might also perform exceptionally well during specific seasons or promotional events.

With their hidden champions identified, marketers are able to tailor campaigns that ensure that not just the current bestsellers are promoted. They uncover also products that have the highest potential to appeal to specific customer segments and hit strategic business goals.

multi-dimensional product segmentation and

smec’s Campaign Orchestrator:

Read the Case Study

What is the strategic value of

multi-dimensional Product Segmentation?

Moving beyond the nuts and bolts of how multi-dimensional segmentation works, it’s crucial to understand the strategic advantages it brings to retailers.

Multi-dimensionality is about getting down to the nitty-gritty of the entire product catalog, helping retailers make smarter decisions about which products to focus on and how to best market them. It’s about fundamentally transforming how businesses connect with their customers, position their products, and ultimately, enhance their bottom line.

- Increased visibility of underperformers: Multi-dimensional product segmentation identifies products with scarce data or low current performance and enhances their visibility. This helps tapping into untapped growth potentials.

- Refined product positioning: Multidimensionality considers a broad spectrum of factors to highlight products of strategic importance. This helps differentiate offerings from competitors.

- Enhanced ROI: By fine-tuning marketing efforts, multi-dimensional analysis aids marketers in concentrating on impactful, highly-targeted campaigns. This ensures marketing budgets are allocated to campaigns with tangible results, thus maximizing profitability.

Unlike the old way of just looking at Sales Volume and ROAS, multi-dimensionality helps retailers match their products with what your customers are actually looking for. This means you can do a better job of getting the right products in front of the right people, leading to more sales and a stronger position in the market.

In other words: multi-dimensional product segmentation is not just about growing you business. It’s about growing your business more efficiently.

Can you do multi-dimensional

Product Segmentation manually?

Technically, yes. If you have a small catalog and endless patience, you can export your data, run VLOOKUPs in Excel to combine margin and stock levels, apply Custom Labels, and re-upload your feed to Merchant Center.

Is it feasible to do multi-dimensional Product Segmentation at scale? No.

And here is why relying on manual uploads is a strategic risk in 2026:

- The “Data Lag” trap: Markets move in real-time. A product might go out of stock or drop in margin on Tuesday morning. If you are relying on a static feed upload from Monday, you are paying to advertise a product you can’t sell (or can’t sell profitably) for 24+ hours. PMax runs on live signals; your strategy cannot run on dead data.

- The complexity ceiling: The human brain—and even the best spreadsheet—struggles to process the intersection of three or four variables across thousands of SKUs. Trying to manually calculate which products are “High Margin AND Low Stock AND High Seasonality” usually leads to formula errors, broken labels, and budget leakage.

- Opportunity cost: Every hour you spend acting as a “Data Janitor”—cleaning CSVs and checking feed errors—is an hour you aren’t spending on strategy, creative, or competitive analysis.

The strategy is right. The manual execution is simply too slow for the speed of modern ecommerce.

How to streamle Product Segmentation

with “Dynamic Segments”

To solve this “feasibility gap,” you don’t need to change your strategy. You just need to change the vehicle.

We recognized that retailers wanted to run complex, profit-driven structures but were getting buried in the manual execution. That is why we baked multi-dimensional segmentation directly into the smec Campaign Orchestrator via a feature we call Dynamic Segments.

Think of Dynamic Segments as a “live rule engine” rather than a static labeling tool.

Instead of manually tagging products, you simply define the logic once. For example, you tell the system:

“If Margin is > 40% AND Stock Availability is High…”

The Campaign Orchestrator then monitors your data streams 24/7.

- It connects the dots: It pulls inventory from your shop system, profit data from your backend, and performance metrics from Google Ads.

- It watches for triggers: As soon as a product hits your criteria, it is automatically moved into the corresponding campaign (e.g., “Profit Drivers”).

- It cleans up: Conversely, if that product’s stock drops below your threshold, it is instantly moved out to a “Low Visibility” segment to save budget.

This removes the error-prone manual work. You define the strategy (the rules), and the software handles the execution (the movement). It ensures your campaigns are always fed the exact right products at the exact right time.

To sum it up

| Metric | Two-dimensional | Multi-dimensional | Implications |

| Sales Volume | Yes | Yes | Broader analysis in a multi-dimensional approach enhances product promotion strategies. |

| Efficiency (ROAS) | Yes | Yes | Multi-dimensional considers broader factors, optimizing beyond cost-efficiency. |

| Product Attributes | No | Yes | Enables precise targeting and product differentiation. |

| Consumer Behavior Insights | No | Yes | Supports personalized marketing, improving customer engagement. |

| Market Trends | No | Yes | Ensures marketing agility and relevance to consumer trends. |

| Profit Margin | No | Yes | Aligns promotions with business profitability. |

| Inventory Levels | No | Yes | Optimizes stock management. |

| Competitiveness | No | Yes | Informs competitive pricing and product positioning. |

| Strategic Importance | No | Yes | Highlights products essential to brand and strategic goals. |

| Niche Appeal | No | Yes | Identifies specialized market opportunities. |

Multi-dimensionality:

Your new best friend?

Let’s cut to the chase: Multi-dimensional product segmentation is the game-changer you’ve been waiting for. It allows you to regain control over “set-it-and-forget-it” campaigns, adding precision to your strategy and driving better ROI.

The Downside

But while this sounds like sunshine and roses, there is a glaring catch: It’s unfeasible to do manually. attempting to wrangle this data by hand is a recipe for burnout. You need smart technology to streamline the process so you can focus on strategy, not spreadsheets.

The Upside

Lucky for you, that’s exactly what smec specializes in. Our solution is purpose-built to sideline PMax’s inherent shortcomings. By feeding the algorithms superior business data, we give you back the granular, item-level control that PMax denies you. With predictive AI and hidden champion detection, we provide insights unattainable out of the box.

Enter the Multiverse

To truly harness this potential, having a partner like smec makes all the difference. Our Campaign Orchestrator was built specifically for this level of granularity. With Dynamic Segments, you can streamline complex data strategies into simple, automated rules. Ensuring your best products always get the budget they deserve without the manual headache.

Wonder how it works?