Subscribe to join thousands of other ecommerce experts

Trying to keep up with Google’s latest PMax updates feels like chasing a moving target—blindfolded.

More control, more transparency, more pro features—kind of. Many of the 2025 updates are legit game changers, long overdue and genuinely useful. Others? Well… they’ve left plenty of you with more questions than answers.

In my latest webinar, PMax 2025: What’s Next for Your Ecommerce Strategy, we unpacked the biggest changes—what’s great, what’s still a black box, and what might just shake up how you run campaigns.

You had a ton of questions, so here’s the straight-up rundown on what really matters—and how to actually make these updates work for you.

Let’s cut through the noise:

Table of Contents

PMax campaign setup

As mentioned in the question above, you need to be careful about hybrid/parallel structures due to the risk of self-competition.

I would choose which foot you want to put forward – what your primary campaign type will be. I recommend PMax because these highly-automated campaign types are the future not only of Google Ads, but all digital advertising platforms. It’s important to develop the skills and processes now.

From an in-platform performance perspective, I would expect PMax to typically be stronger. From a back-end business perspective, the incrementality of PMax can be called into question, but the part no one likes to discuss is that Shopping is also not “The World’s Most Incremental Campaign Type.”

In both cases you need to help Google’s algorithm work harder by reflecting your goals, your customers, and your product data.

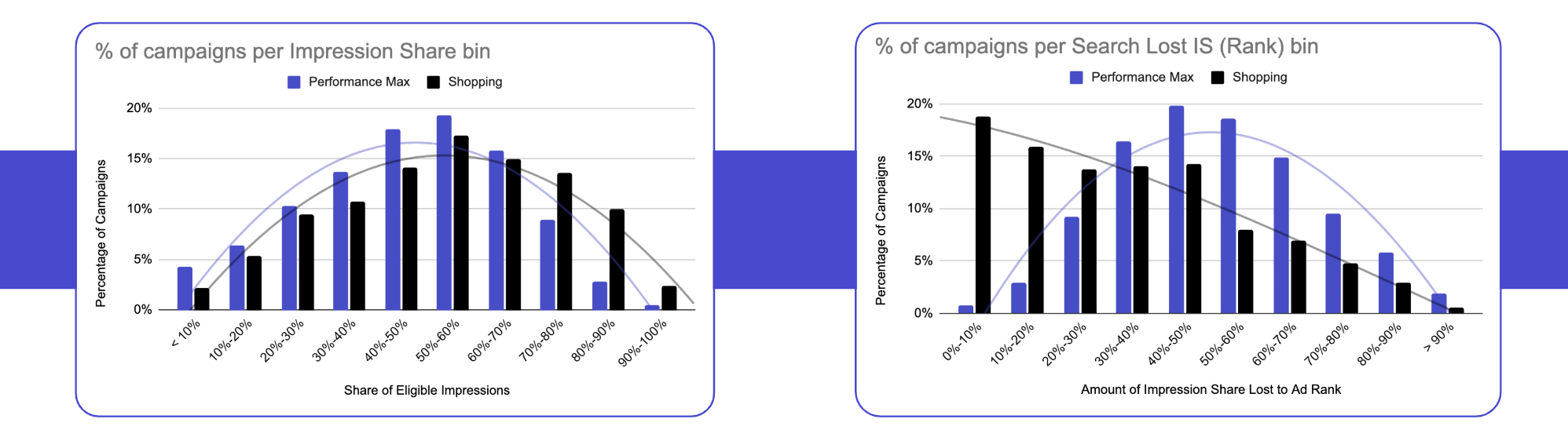

You can run PMax and Shopping in parallel, however it needs to be done carefully. This is especially true as of October 2024, when Google announced that PMax no longer takes priority over Shopping.

While many advertisers welcomed this news, it comes with the trade-off that these campaign types can cause your bids to escalate. While on paper the campaign conflict is resolved via ad rank, the ads, landing pages, and query targeting are so similar that it comes down to bidding, as confirmed by Google.

Bearing this in mind, it’s important to consider why you want to run them in parallel: What is my expectation of each campaign type, which role should each one play in my strategy?

Yes, we sometimes configure feed-only PMax campaigns. We also use asset-only and full-build PMax campaigns depending on the circumstances. These are all tools in the tool box, and it depends on the goals and strategy of the entire account.

Reasons for using feed-only campaigns could include reducing interference with Search campaigns or other campaign types, a lack of assets or audience signals, etc.

Typically I don’t see a huge performance difference between feed-only and full-build, so I would look at what other effects you are aiming to achieve or prevent within the account.

I am probably more forgiving of full-asset PMax than some people.

However, I feel that Google hasn’t made the business case clear enough. From what I can tell, there is little-to-no downside of using a feed-only campaign and little-to-no upside of using a full-asset campaign.

That’s something Google needs to work on if they want to convince skeptics.

Brand and Audience strategies

It is not necessary to separate brands because of reporting, because brand is a supported dimension in Report Editor.

It can be a good idea to separate brands for optimization. I would follow this logic: do the brands need a dedicated budget? (e.g. due to vendor agreements, co-op, etc). If yes, then split them out.

Do you have a large amount of high-quality brand assets, and/or do your customers perceive in a highly “categorical” way? If yes, it might make sense to segment on a thematic basis.

However my preferred solution would be to use brand as an inventory scoring attribute. This allows you to keep a smaller, more consolidated set of campaigns (easier to manage; preserves data volume) and items will land in the correct campaign on the basis of their score, where brand is part of that score.

This is complicated so bear with me.

First off: “to preserve historical performance data.” Your historical data is there, it’s not going anywhere.

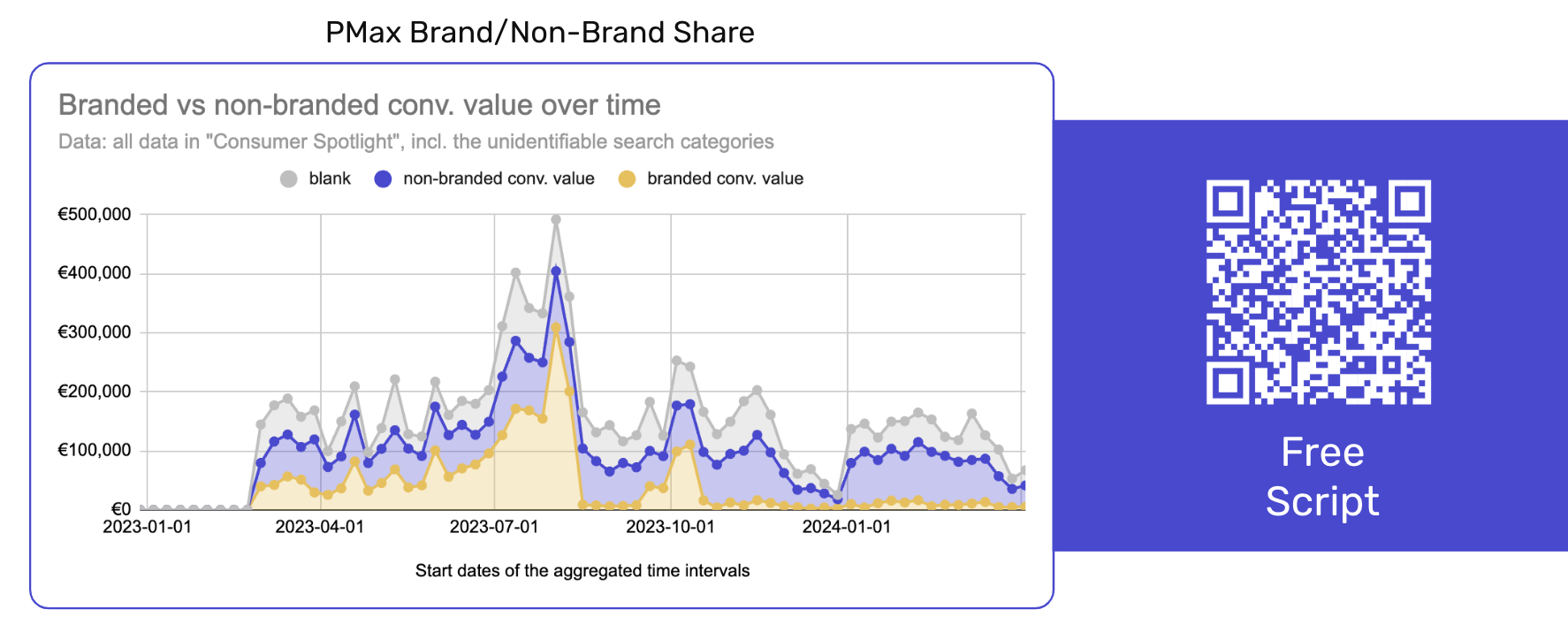

I think what you’re asking about is preserving future data volumes. We have a script that can help you understand how much of your monthly conversion volume comes from brand/non-brand traffic. If your non-branded monthly conversions are typically less than 30, you might want to keep that campaign intact with brand traffic to avoid disruption.

Regarding an “includes brand” and “excludes brand” campaign in parallel: in theory this can work, but since it’s not a true brand/nonbrand split, I find it messy.

I would consider introducing additional differentiation into the campaigns. For example, strongly differentiated bids/budgets, different products, different audiences/demographics, different goals (e.g. NCA-only bidding).

And connecting the dots… It sounds like you want to preserve volume across two campaigns. This is another “in theory it works” topic. In theory, Smart Bidding learns at the conversion action level, meaning it can learn across campaigns within an account as long as they share the same conversion action. However, in practice, I don’t have evidence to support that.

In my assessment, campaigns live or die based on their own volume, not “sibling” or “family” volume.

If you are dealing with volume issues, I would make a good clear decision on brand traffic and then try to keep as much consolidation as possible.

Yes, in certain circumstances.

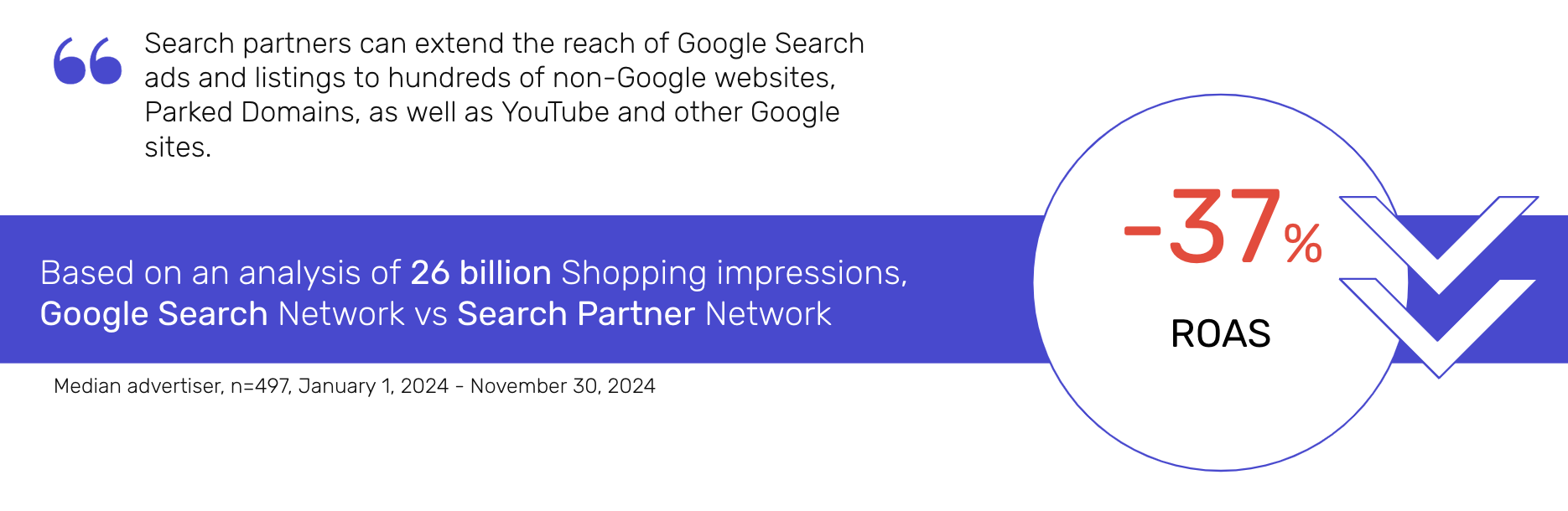

PMax and Demand Gen share a lot of inventory and formats. In theory, the conflict between them is resolved via ad rank. However, similar to the PMax-Shopping conflict, the bid is often decisive.

This risk is particularly high if you have built your Demand Gen campaign “like PMax,” that is, conversion-oriented and including a product feed.

My recommendation is to let Demand Gen be Demand Gen. Embrace it as a mid-funnel campaign type, don’t make it too performance-oriented, and be mindful of your product overlap with PMax if you include a feed.

Otherwise you basically turn it into a low-funnel campaign, which is not what it was built for and which can be highly competitive with PMax.

Product segmentation & prioritization

Yes, price benchmarks are still available in Merchant Center, and it seems they will also be returning to Google Ads. I don’t know why they were removed as it was very handy to have that data easily available and side-by-side with product and campaign performance data.

It doesn’t quite compare against the average price. Google uses the click-weighted average. This has the advantage of implicitly aligning the benchmark to CTR and consumer demand.

In your Google Ads account, go to the Campaigns section and click the Audiences, keywords, and content dropdown. Select Content, then navigate to the Exclusions tab and click Edit exclusions. Finally, choose Account and add your exclusions. For up-to-date, detailed info, check Google Support’s instructions.

Unpopular answer, but yes I do trust Google with COGS data.

It’s clear that the incentive is there to misuse this data. However I don’t think Google is in a position to know what a given gross profit level means to your business. Which gross profit is “good” or “high” or “low” will depend on company’s size, growth stage, vertical, geo, etc – and can further vary within a company across products and categories.

I guess Google could determine which products yield higher margin relative to others in the assortment but… you still have your ROAS target, and I’m simply not convinced. Furthermore, in Report Editor you can report not only your gross profit but also your gross margin.

If you are concerned about this, you can still reflect profit in a private way using server-side tagging.Unpopular answer, but yes I do trust Google with COGS data.

It’s clear that the incentive is there to misuse this data. However I don’t think Google is in a position to know what a given gross profit level means to your business. Which gross profit is “good” or “high” or “low” will depend on company’s size, growth stage, vertical, geo, etc – and can further vary within a company across products and categories.

I guess Google could determine which products yield higher margin relative to others in the assortment but… you still have your ROAS target, and I’m simply not convinced. Furthermore, in Report Editor you can report not only your gross profit but also your gross margin.

If you are concerned about this, you can still reflect profit in a private way using server-side tagging.

Campaign efficiency & bidding strategies

It will optimize for gross profit instead of revenue. No, you can still set a ROAS target and it’s not imaginable to me that gross margin will get worse

Google Ads & the future of PMax

I don’t know.

People have been asking since probably 2019 – including me – and I just don’t know. Shopping still represents an unignorable percentage of Google Ads budget for ecommerce, and the reaction from advertisers would be ugly. So honestly I think it’s too risky as of today.

I think they will continue their strategy of presenting PMax as the default option and adding features to PMax. If and when the risk becomes manageable, they might take that next step.

I’m excited that PMax has been improving in terms of transparency and control. I’m thrilled to see the recent addition of device targeting and demographic exclusions, for example.

However I’m most excited about Google’s work on expanding goal types and moving “upstream” with those, in the sense of toward more mature and challenging targets than just ROAS and revenue. They’re working new customer acquisition, profit bidding, high-value customers, etc. I like that.

I’m most concerned about Search Max and recent focus groups directed at migrating Search campaigns toward PMax. I first said three years ago that PMax is “a new advertising platform incubating within the old one” and that other campaign types “will shrink into something vestigial – like a tailbone or an appendix.”

While I generally advise everyone to get comfortable and skilled with PMax for exactly this reason, I do simultaneously find it troubling.

Conclusion

Love it or hate it, PMax is charging full speed ahead, and 2025 is shaping up to be a wild ride.

The good news? Google is finally handing over more levers to pull. The catch? You still need to steer the beast in the right direction.

The next few months will be all about testing, tweaking, and making these updates actually work for your business—because let’s be real, Google’s automation won’t magically align with your goals on its own.

Want the full scoop on what’s changing, what’s working, and what still needs some… fine-tuning? Catch the full webinar here: